Personal Banking

Our Personal Savings Account is designed for individuals engaged in business and agricultural activities.

Corporate Banking

Our Corporate Account is specifically designed to support the financial needs of cooperatives, self-help groups (SHGs) etc.

Loan

At BOA, we offer loan facilities for individuals, farmers, women, youth, SMEs, cooperatives, and corporates.

BOA MANDATE

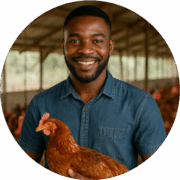

Rural and Agricultural Finance

It’s our mandate to provide agricultural credit facilities to support all agricultural value chain activities, provide non-agricultural micro credit, Savings mobilization, Capacity development. This we achieve through cooperative development of agricultural information system and provision of technical support and financial advisory services.

BOA has remained a trusted partner to smallholder farmers, agribusinesses, and rural entrepreneurs for over five decades.

Empowering Farmers,

Driving Prosperity

Sustainable Finance for

Every Season

Innovating Agriculture

for Tomorrow

Our Impact

Whats New

Never miss what we are up to – Latest News, Blogs, Press Release, Events etc.

Happy Birthday to the Chairman of Bank of Agriculture, Mohammed Babangida.

Happy 54th Birthday to the Chairman of Bank of Agriculture, Mohammed Babangida.⁰⁰We wish you continued success, good health, and many more years of making a difference.⁰⁰Happy Birthday Sir!

#BOA pic.twitter.com/bNRgqV1h50— Bank of Agriculture (@bankofagricng) February 4, 2026